Taking Control Of My Investments - The Boglehead Way

I recently took control of my investments. Previously, I used a financial advisor for my Roth IRA and was only invested in a target date fund in my 401k. Both of these methods are perfectly fine for anyone who wants a relatively hands off approach to investing. However, I think you will find the following information can lead to a less complicated, cheaper, and more rewarding investment experience.

At the beginning of this year, I discovered a reddit forum called Bogleheads, named after Jack Bogle, the founder of Vanguard. I started reading post after post, and realized how simplistic, and passive, investing can be. The official Bogleheads forum and wiki is filled with tons of great knowledge that I spent weeks pondering through. I discovered terms such as expense ratios, asset allocation, and the one that has changed my outlook on investing as a whole, the three fund portfolio.

There is so much knowledge to go through in the reddit forum and the Bogleheads website, I encourage you to take a look for yourself. I want to highlight the key takeaways I have been using since the beginning of this year to take control of my investments.

Expense Ratios and Fees

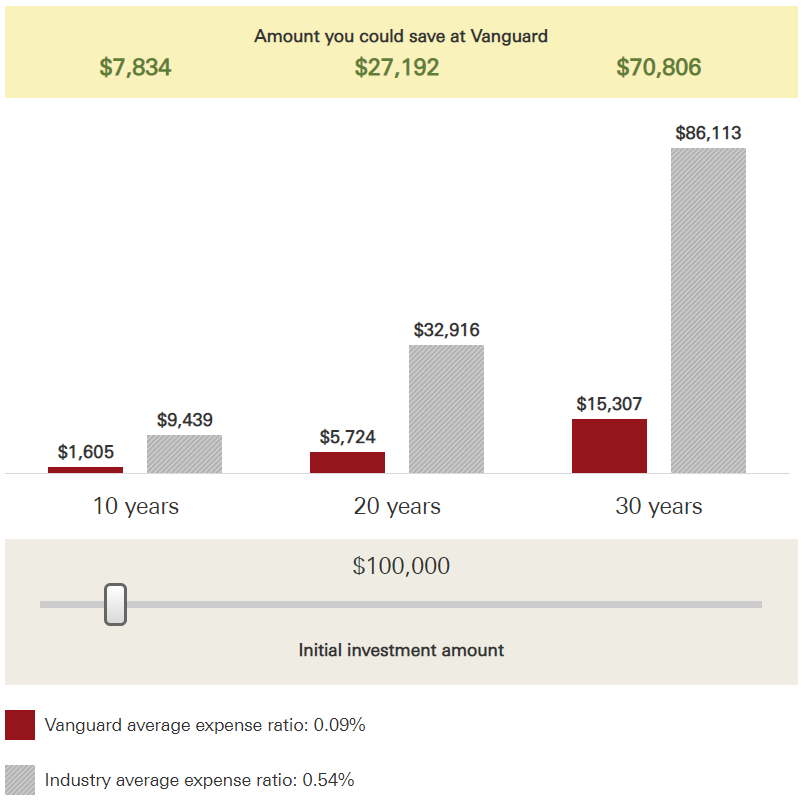

I never gave much thought to how much I was paying in fees to my advisor, and the funds that I was invested in. My thought process was that since I did not have that much invested, why would I care about how much I am paying? Expense ratios are most always displayed as a percentage, for example 0.7%. The average expense ratio for a mutual fund is between 0.5% and 1.0% per year of the amount you have invested in that fund. On top of that, most advisors and firms charge an annual fee between 0.5%-1.0% of your assets under management (total account value). Now, that may not seem like much, but over the course of 30 years that can really add up. Vanguard has a nice calculator that allows you to visualize how much you could save with low-cost funds which can be found here. Below is an example of the potential savings over 30 years with an initial investment of $100,000.

After learning about expense ratios, I went to look at my investments my financial advisor had me invested in and was shocked at how high some of them were. This was only the beginning of why I chose to take control of my investments.

Asset Allocation

I had previously known about asset allocation, however my financial advisor chose my allocation based on a questionare I would fill out every year. That questionaire was supposed to determine my risk tolerance. I never questioned my risk tolerance or my asset allocation until I read countless times that young investors should be heavily invested in equities. There are arguments that young investors should be invested in 100% stocks, and some who say you should be invested in 100 or 120 - your age, and the remainder in bonds. Ultimately, it comes down to what your risk tolerance is and how you would handle a sudden decrease in your portfolio value in the event of a bear market. I err on the side of having a more risky asset allocation because of my age and the amount of time I still have left until retirement. As I get closer to retirement, I will start increasing my bond allocation. As Jack Bogle used to say, it’s time in the market rather than timing the market.

Three and Four Fund Portfolio

As I said earlier, this is the key point that completely changed my outlook on investing. The three, or four, fund portfolio is an aptly named strategy in which you are only invested in three or four funds. Currently, I use the four fund portfolio strategy. This consists of Total Stock Market, Total Bond Market, Total International Stock Market, and Total International Bond Market. The three fund portfolio is the same with the exception of no Total International Bond Market. I was blown away that investing could really be that easy. My portfolio with my financial advisor had at least 15 funds my money was invested in. This not only makes keeping track of investments cumbersome, but it is also expensive. The three and four fund portfolios work so well because they capture the entire market, whether it be stocks or bonds. This reduces drastic swings in prices as opposed to being invested in individual stocks or bonds. Sure, you could be invested in stocks that skyrocket in value. But you could also be invested in stocks that plumet in value just as fast. Owning the whole market gives you ultimate exposure and reduces risk.

Putting It All Together

After much research, I let my financial advisor know I was going to be moving my money out and investing on my own. I opened an account with Vanguard and transferred my Roth IRA to a new Vanguard Roth IRA. I re-allocated my holdings to reflect the four fund portfolio with my desired asset allocation. I also created a brokerage account at Vanguard which I will use to put any extra cash I have to invest, utilizing the same strategy. My 401k was previously invested in a target date fund, which automatically adjusts the asset allocation for you (but at a high expense). My current 401k does not offer Total International Bond, so I went with the three fund strategy. Managing my investments on my own has lowered my costs which will in turn put more of my money to work.

The Bogleheads strategy is a passive investment strategy. I encourage you to do your own research and find out for yourself. You can implement this strategy in pretty much any brokerage, it does not have to be Vanguard.